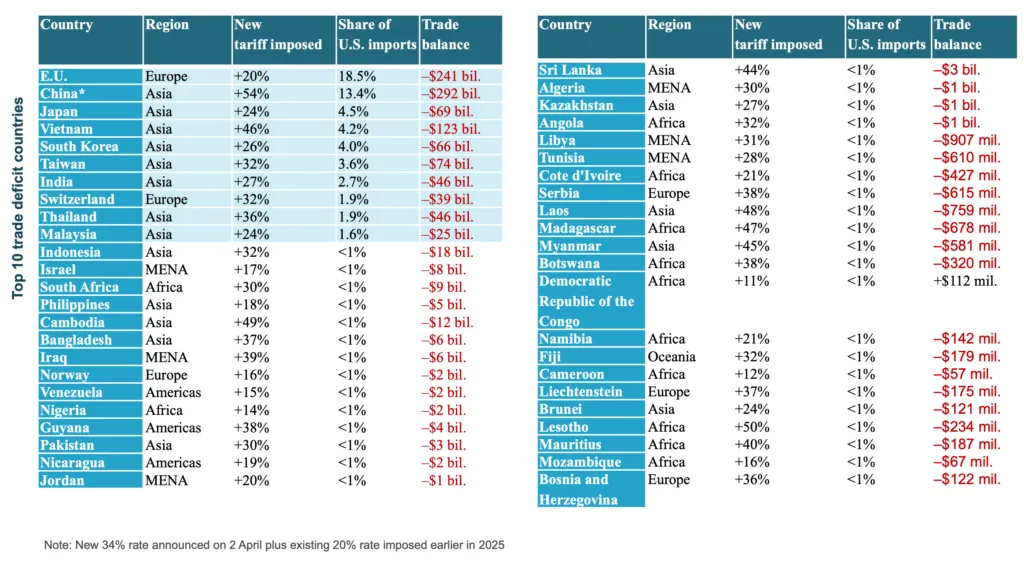

The world has entered a new era of trade volatility, driven by President Trump’s new tariff policies that have upended decades of globalization. With sweeping measures—including a 10% universal import duty, reciprocal tariffs targeting over 60 nations, and sector-specific levies on autos, steel, and semiconductors—the U.S. is reshaping global supply chains. While traditional manufacturing powerhouses in Asia reel from tariffs as high as 145% on Chinese goods and 46% on Vietnamese exports, the Middle East and North Africa (MENA) region is emerging as an unexpected beneficiary, poised to rewrite its role in global trade.

The Tariff Tsunami: A Global Disruption

Trump’s trade agenda, rooted in reducing a $1.2 trillion U.S. trade deficit and revitalizing domestic industries, has created a ripple effect. The latest tariffs have exacerbated the economic challenges for China, which has been a primary target of the US trade war. The imposition of tariffs on Chinese goods has the potential to reduce their competitiveness and slash exports, particularly in key industries such as electronics, machineries, and textile.

China has responded to these tariffs with its own set of retaliatory measures, including imposing tariffs on US goods and restricting imports of certain American products. This tit-for-tat escalation has strained the economic relationship between the two countries and created uncertainty in global markets. The impact on China’s economy has been significant, with a slowdown in GDP growth and disruptions in supply chains. The long-term effects of these tariffs on China’s economy are expected to be substantial, with potential losses in GDP growth and a decline in manufacturing investment.

Figure 1: Top 10 trade deficit countries with the US

Yet, amid this chaos, MENA stands out as a relative haven. Shielded by strategic U.S. alliances, favorable trade dynamics, and sector-specific exemptions, the region is transforming into a critical re-export and manufacturing hub. As global businesses scramble to diversify away from tariff-battered regions, MENA’s unique blend of geopolitical stability, logistical prowess, and economic adaptability is drawing unprecedented attention.

Why MENA Avoids the Tariff Crosshairs

- Favorable Trade Balance: A Buffer Against Retaliation

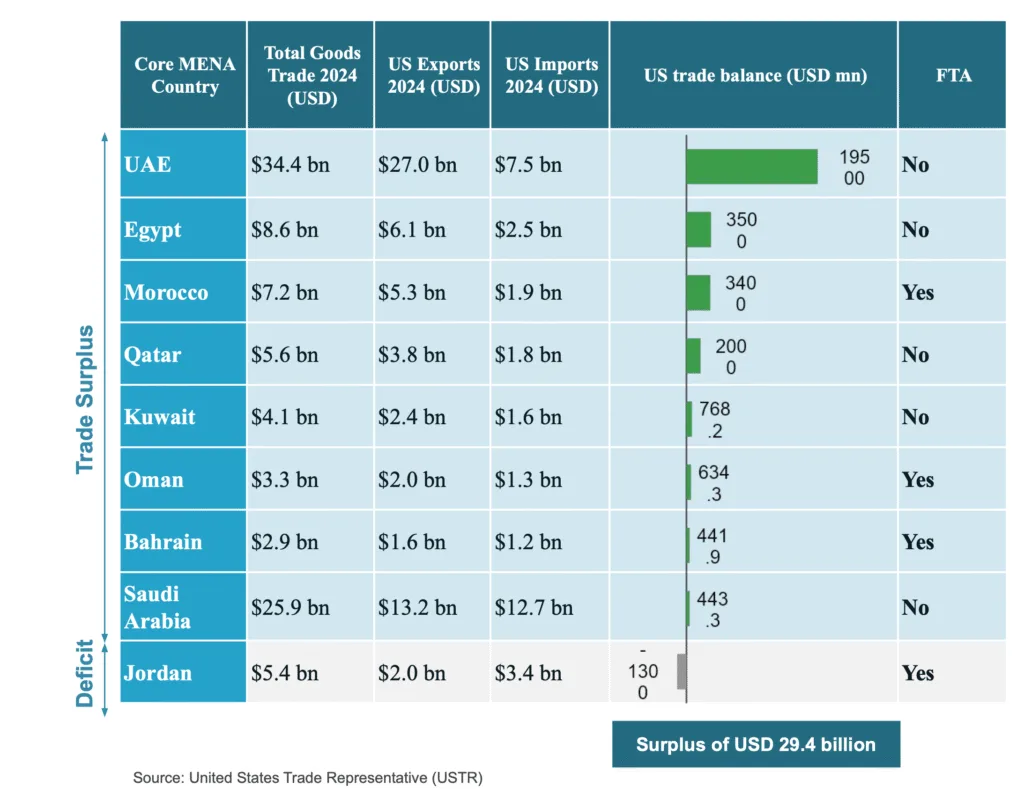

Unlike China (with a $292 billion trade deficit with the U.S. in 2024) and Vietnam ($123 billion), MENA nations collectively run a $29.4 billion trade surplus with the U.S., driven by energy exports and niche industrial goods (see Figure 2). Countries like the UAE, Egypt, and Morocco—key players in this surplus—have ample room to absorb manufacturing relocations without triggering U.S. scrutiny. The lack of a deficit means tariffs on MENA goods are less likely to become a political or economic target, providing a stable environment for long-term investment.

Figure 2: Core MENA countries’ trade surplus with the US

2. Energy Exemption: A Strategic Lifeline

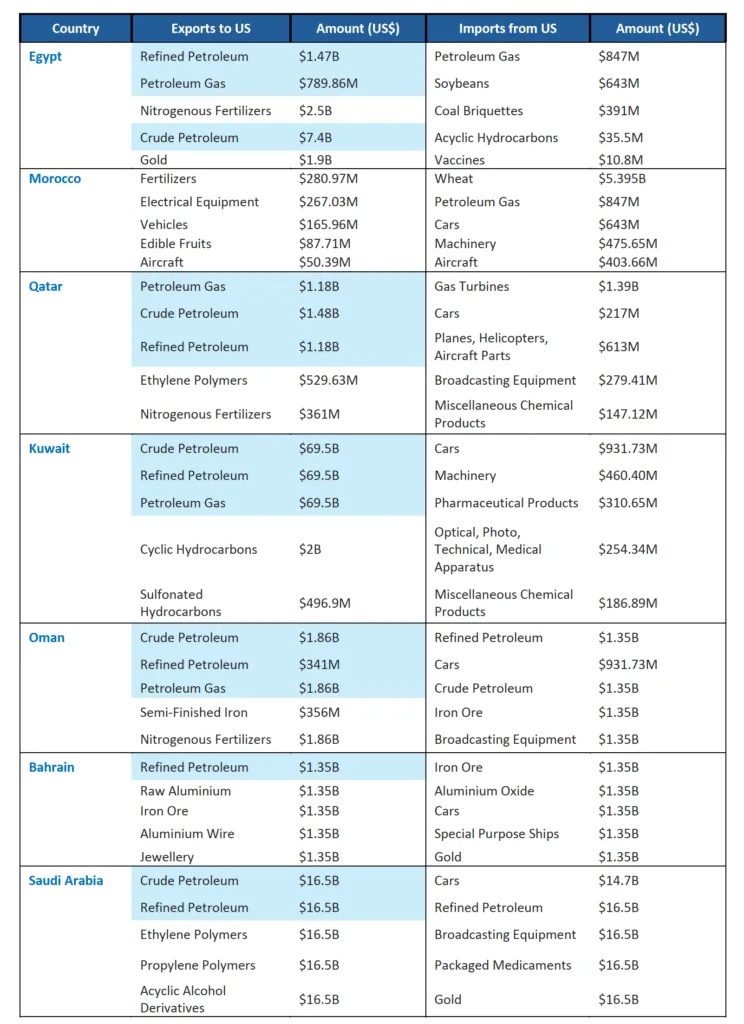

Over 70% of MENA exports to the U.S. comprise oil, gas, and refined products (see Figure 3). Imposing tariffs on these would risk spiking U.S. energy prices, worsening inflation, and harming domestic industries reliant on affordable fuel—contradicting Trump’s goal of strengthening U.S. manufacturing. Recognizing this, the U.S. has exempted energy-related imports from its new tariffs, safeguarding MENA’s largest export sector and preserving the region’s role as a vital energy partner

Figure 3: MENA countries’ top exports to US and imports from US

3. Diplomatic Alliances: A Shield of Stability

MENA’s close ties with the U.S., cemented by defense partnerships, energy collaborations, and frequent high-level engagements (including Trump’s planned Spring 2025 visit to discuss investment agreements), reduce the likelihood of punitive tariffs. Additionally, there are robust economic ties and partnerships between the US and MENA in terms of trade and investments, especially in machinery, agriculture, LNG projects and other energy technology. The US aims to maintain these alliances, which further reduces the likelihood of increased tariffs on MENA countries.

Thus, while the latest US tariffs have had a significant impact on global trade, the MENA region has been relatively less affected compared to other regions like China and Southeast Asia and there is ample room for manufacturing and re-export to be allocated to MENA as an alternative to brace against future trade uncertainties.

MENA’s Rise as a Strategic Manufacturing and Re-Export Haven

We believe MENA is well-positioned to take on a larger and increasingly critical role in manufacturing with the friendshoring trend. This trend involves rerouting supply chains to countries regarded as political and economic allies, which would particularly benefit MENA countries due to their strong ties with the US. The region is emerging as an attractive destination for businesses looking to relocate. In addition to the lower tariffs relative to traditional manufacturing hubs, MENA offers a multitude of benefits and advantages in and of itself.

- Logistical Excellence: The Crossroads of Three Continents

MENA’s strategic location—bridging Asia, Europe, and Africa—paired with world-class infrastructure, makes it ideal for global trade. Ports like Dubai’s Jebel Ali (the world’s ninth-largest container port) and Saudi Arabia’s King Abdul Aziz Port facilitate seamless re-export, while logistics hubs like Dubai Logistics City enable efficient supply chain management. For companies seeking to serve both Eastern and Western markets, MENA offers a cost-effective midway point, cutting transportation times and costs. - Mature and Favourable Operational Environment

The MENA region offers manufacturers a compelling mix of cost efficiency, skilled labor, and abundant energy. With labor costs in Egypt and Morocco 30–40% lower than in China’s coastal provinces, coupled with a workforce trained to meet global quality standards, businesses can benefit significantly. Gulf nations enhance this advantage with expatriate expertise across advanced sectors. Additionally, affordable energy resources allow for industrial electricity prices, making it cost-effective for energy-intensive industries. With business-friendly policies and streamlined logistics, MENA serves as a stable base for manufacturers seeking to mitigate supply chain disruptions and leverage tariff advantages. - Political Stability and Regulatory Clarity

Countries like the UAE and Qatar have cultivated reputations as neutral, business-friendly jurisdictions, attracting global capital amid geopolitical uncertainties. Free zones across the region offer tax exemptions, 100% foreign ownership, and streamlined regulations, while initiatives like Saudi Arabia’s Vision 2030 and Egypt’s Suez Canal Economic Zone provide long-term policy certainty—critical for large-scale manufacturing investments.

Seizing the Opportunity: Sectoral Winners in MENA

- Textiles & Apparel: With U.S. tariffs crippling Chinese textile exports (25% on $250 billion worth of goods), Egypt and Morocco are stepping in. Morocco’s Tangier region neighboring Tanger Med Port, already a hub for Inditex’s brands such as Zara and H&M, is expanding to serve U.S. markets, capitalizing on duty-free access via the U.S.-Morocco FTA. Also, Abu Dhabi’s Khalifa Industrial Zone (KIZAD)—adjacent to Khalifa Port, one of the region’s largest deep-sea ports—offers duty-free access to U.S. and EU markets for manufacturers of specialized fabrics.

- Automobiles & Auto Parts: U.S. tariffs on Chinese auto components (25%) are driving automakers to Morocco and Tunisia, where low labor costs and proximity to Europe create ideal export hubs. For example, Saudi Arabia’s King Abdullah Economic City is positioning itself as an EV manufacturing hub, aligning with global green energy trends. UAE is positioning itself as a smart mobility and electric vehicle (EV) innovation hub, with Abu Dhabi at the forefront. The emirate’s ADQ holding has invested billions in EV infrastructure, including partnerships with global players like Nio to set up assembly plants in Khalifa Economic Zone.

- Electronics & Semiconductors: While MENA is not yet a tech manufacturing giant, its tariff advantages and growing tech ecosystems (e.g., Dubai’s Silicon Oasis) are attracting companies looking to avoid Asian tariff traps, particularly for assembly and testing phases, attracting firms like STMicroelectronics and GlobalFoundries. The UAE’s National Policy for the Semiconductor Industry—backed by $20 billion in investments—aims to develop a local chip ecosystem, leveraging low-energy costs (solar-powered facilities in Abu Dhabi’s Al Dhafra region) and duty-free imports of raw materials.

The Road Ahead: A New Chapter in Global Trade

Trump’s tariffs have done more than disrupt—they’ve redrawn the map of global manufacturing. As reliance on Southeast Asia wanes, MENA’s combination of tariff resilience, strategic location, and proactive economic reforms makes it a rare bright spot in an otherwise turbulent landscape. For businesses seeking to future-proof against trade wars, the message is clear: MENA is no longer a peripheral player but a central node in the evolving global supply chain.

As the region continues to invest in innovation, sustainability, and infrastructure, its rise as a manufacturing and trade hub could mark a lasting shift in global economic power—one where geopolitical wisdom and strategic foresight outpace the volatility of tariffs. In a world of uncertain trade, MENA is proving that resilience is not just about weathering storms—it is about building havens where businesses can thrive.

Data sources: U.S. Census Bureau, World Trade Organization, International Monetary Fund