01

Tailored investment strategy

for the diverse markets

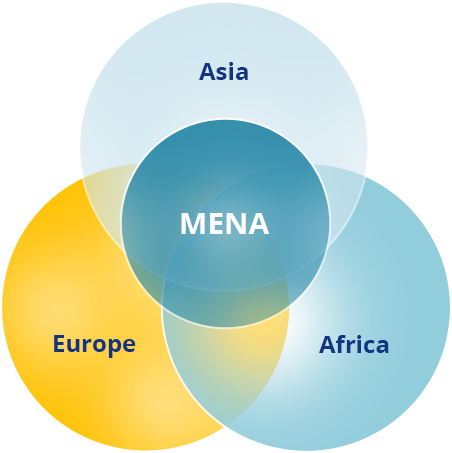

We focus on MENA as a region but adopt a tailored investment strategy for the diverse markets with different levels of technology maturity based on an assessment of local demand and business viability.

A regional investment strategy allows us to diversify risk while capturing significant upside from regional scalability potential.

02

Focus on Scale-up

to support 1-to-100 journey

We focus on a scale-up opportunity where we can add the most value for investors and companies. As a foreign VC, has experience in identifying high-potential MENA candidates more accurately in their scale-up stage.

We aim to build a strong bond with startups early on by being one of their first foreign investors and expanding their business and fundraising network to global markets.

03

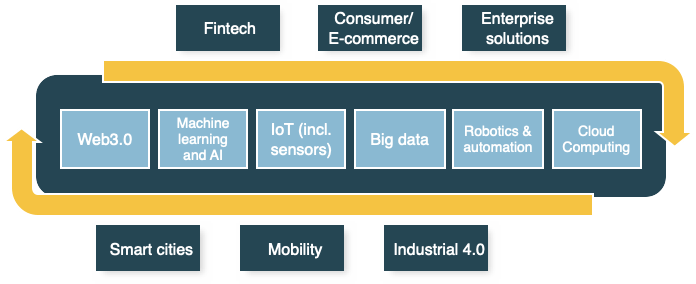

Technologies related to

PEOPLE and DIGITAL

INFRASTRUCTURE

We see strong potential in an investment opportunity that is impacting the way people live, interact, and work. We also believe that digital infrastructure including smart cities will play a pivotal role in sustaining and managing the growing urban population while sparking social transformation, efficiency, and sustainability across MENA markets.